Contents

- 1 Potential Functions of Quantum Computing in Portfolio Optimization

- 2 Quantum Machine Studying in Portfolio Optimization

- 3 Quantum Computing for Asset Pricing and Threat Evaluation

- 4 Quantum Computing for Portfolio Diversification and Optimization Methods: What Are The Potential Functions Of Quantum Computing In Portfolio Optimization?

Potential Functions of Quantum Computing in Portfolio Optimization

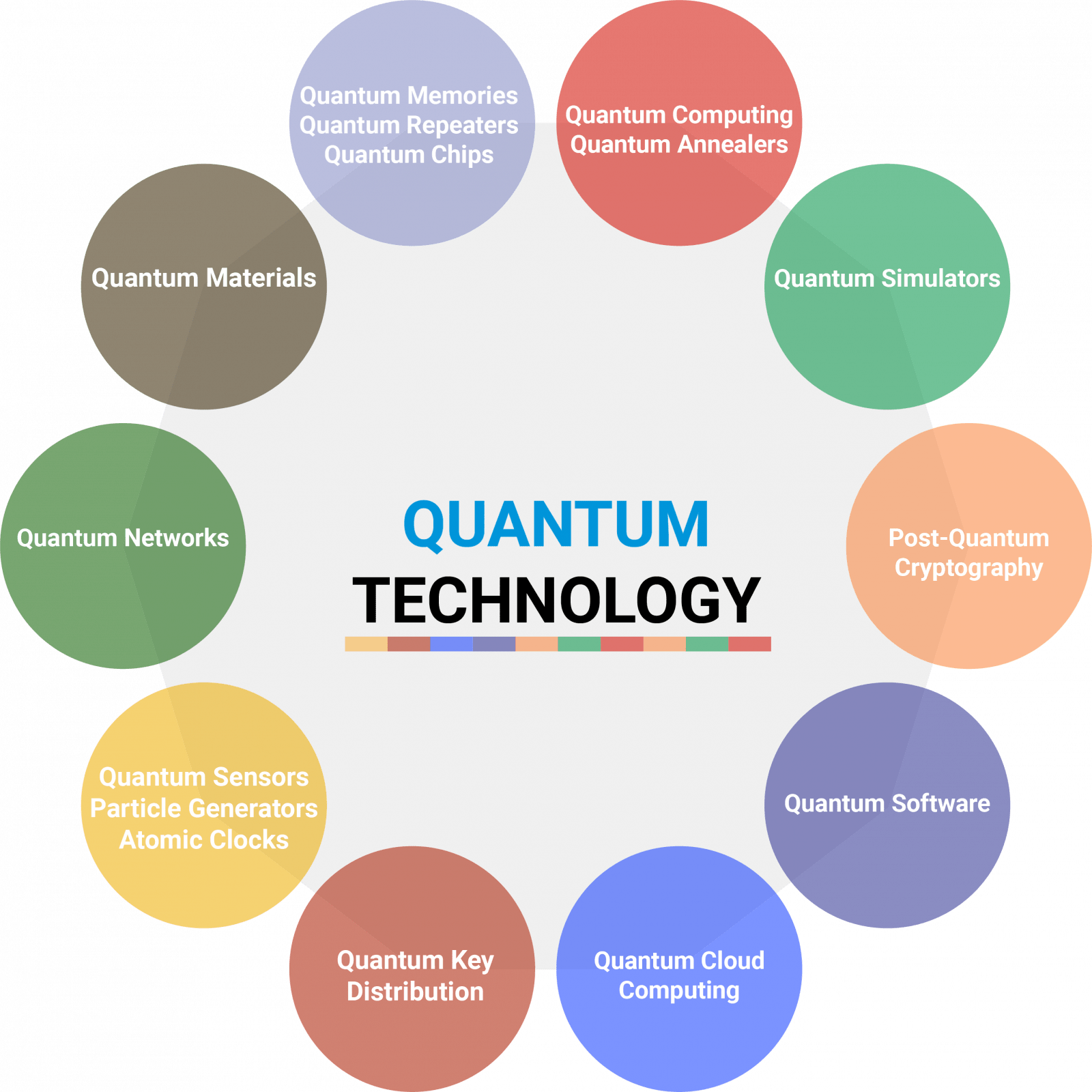

Quantum computing has the potential to revolutionize portfolio optimization by providing elevated effectivity and accuracy in decision-making processes. Conventional strategies typically battle with the complexities of huge information units and complex calculations required for optimum portfolio configurations. Quantum computing can handle these challenges and supply revolutionary options for threat administration and computational energy.

Enhancing Effectivity in Portfolio Optimization

Quantum computing permits for the exploration of a number of potentialities concurrently by means of quantum superposition and entanglement. This functionality allows the analysis of an enormous variety of potential portfolio combos in a fraction of the time in comparison with classical computing strategies. By leveraging quantum algorithms, portfolio managers can rapidly determine optimum asset allocations that maximize returns and decrease dangers.

Addressing Challenges in Conventional Portfolio Optimization

One of many key challenges in conventional portfolio optimization is the complexity of analyzing correlations amongst completely different belongings and adjusting weights accordingly. Quantum computing can effectively deal with these advanced calculations by processing large-scale information units and optimizing portfolios based mostly on various elements. This functionality can result in extra sturdy and resilient funding methods in dynamic market situations.

Influence on Threat Administration Methods

Quantum algorithms supply refined threat evaluation instruments that may improve threat administration methods inside portfolio optimization. By integrating quantum computing methods, portfolio managers can precisely quantify and mitigate dangers related to varied asset courses. This improved threat evaluation can result in extra knowledgeable decision-making and higher safety in opposition to market uncertainties.

Evaluating Computational Energy

The computational energy of quantum computing in portfolio optimization surpasses classical strategies by leveraging quantum parallelism and quantum interference. Quantum computer systems can effectively course of advanced optimization issues and supply options that classical computer systems could battle to attain inside an affordable timeframe. This computational benefit positions quantum computing as a game-changer within the discipline of portfolio optimization.

Quantum Machine Studying in Portfolio Optimization

Quantum machine studying methods have the potential to revolutionize portfolio optimization by harnessing the facility of quantum computing to course of huge quantities of information and optimize advanced portfolios extra effectively than classical strategies.

Utility of Quantum Machine Studying in Portfolio Optimization

- Quantum algorithms resembling Quantum Principal Part Evaluation (PCA) could be utilized to extract significant info from historic monetary information and determine patterns that may assist in developing optimum portfolios.

- Quantum Assist Vector Machines (SVM) could be employed to categorise belongings based mostly on threat and return profiles, aiding within the collection of belongings for a well-diversified portfolio.

- Quantum Boltzmann Machines can be utilized to mannequin the correlations between completely different belongings in a portfolio, resulting in simpler threat administration methods.

Benefits of Quantum Machine Studying over Classical Machine Studying

- Quantum machine studying algorithms can deal with exponentially giant datasets and complicated computations extra effectively than classical machine studying algorithms, permitting for extra correct portfolio optimization.

- Quantum algorithms have the potential to find non-linear relationships in monetary information that could be missed by classical algorithms, resulting in better-informed funding choices.

- Quantum machine studying can present quicker options to optimization issues, enabling real-time portfolio changes in response to altering market situations.

Efficiency Comparability of Quantum Machine Studying Fashions

- Quantum machine studying fashions have proven promising leads to portfolio optimization duties, outperforming conventional fashions when it comes to computational pace and accuracy.

- Quantum algorithms have the potential to uncover extra environment friendly portfolio optimization methods that may result in larger returns and lowered threat in comparison with classical strategies.

- Whereas quantum machine studying continues to be in its early levels, ongoing analysis and growth are anticipated to additional improve the capabilities of quantum algorithms for portfolio optimization.

Quantum Computing for Asset Pricing and Threat Evaluation

Quantum computing holds immense potential in reworking asset pricing accuracy and threat evaluation inside portfolio optimization. By leveraging the ideas of quantum mechanics, quantum computing can supply options to advanced optimization issues that conventional computer systems battle to effectively handle.

Improved Asset Pricing Accuracy

Quantum computing algorithms can present extra exact asset pricing fashions by contemplating a mess of variables concurrently. The flexibility to course of huge quantities of information and carry out advanced calculations in parallel permits for extra correct valuation of belongings inside a portfolio. Algorithms like Quantum Amplitude Estimation can improve the accuracy of pricing fashions by effectively estimating the anticipated return of belongings.

Threat Mitigation in Funding Portfolios

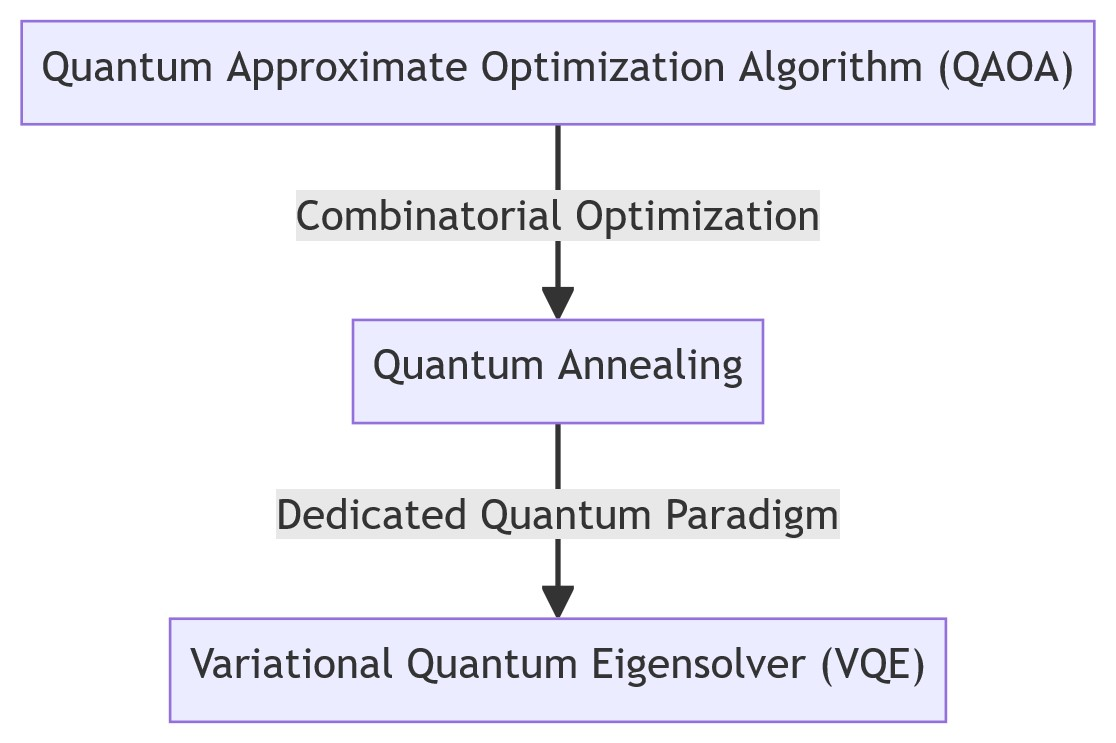

Quantum computing performs a vital function in evaluating and mitigating dangers related to funding portfolios. By analyzing varied threat elements and correlations between belongings at an accelerated tempo, quantum algorithms can determine potential dangers and optimize portfolio diversification methods. Quantum algorithms resembling Variational Quantum Eigensolver (VQE) may also help in assessing threat publicity and optimizing portfolio compositions to reduce dangers.

Quantum Algorithms for Asset Pricing and Threat Evaluation

Quantum algorithms like Quantum Amplitude Estimation, Variational Quantum Eigensolver (VQE), and Quantum Principal Part Evaluation (PCA) are generally used for asset pricing and threat evaluation in portfolio optimization. These algorithms allow environment friendly computation of asset valuations, threat metrics, and correlations, resulting in extra knowledgeable funding choices.

Actual-World Functions of Quantum Computing

Actual-world examples showcase the profitable utility of quantum computing in asset pricing and threat administration. For example, monetary establishments are exploring quantum algorithms to optimize portfolio building and threat evaluation processes. Firms like Goldman Sachs and JPMorgan Chase are actively researching quantum computing functions to boost asset pricing accuracy and mitigate dangers of their funding portfolios.

Quantum Computing for Portfolio Diversification and Optimization Methods: What Are The Potential Functions Of Quantum Computing In Portfolio Optimization?

Quantum computing affords a novel alternative to revolutionize portfolio diversification and optimization methods on the earth of finance. By harnessing the facility of quantum algorithms, traders can discover an enormous variety of potential portfolio combos effectively and successfully.

Optimum Diversification Methods

- Quantum computing can help in growing optimum diversification methods by analyzing a mess of belongings and their correlations concurrently.

- The flexibility to think about advanced relationships between belongings in a quantum state permits for the creation of diversified portfolios with lowered threat and enhanced returns.

Influence on Threat-Return Profiles

- Quantum computing can considerably impression the optimization of risk-return profiles for diversified portfolios by figuring out probably the most environment friendly asset allocations.

- By using quantum algorithms, traders can obtain a steadiness between threat and return that maximizes the portfolio’s efficiency.

Streamlining Portfolio Rebalancing and Asset Allocation, What are the potential functions of quantum computing in portfolio optimization?

- Quantum computing streamlines the method of portfolio rebalancing and asset allocation by rapidly adapting to altering market situations.

- Actual-time evaluation of portfolio composition and threat elements allows proactive changes to optimize efficiency and decrease losses.

Potential Advantages of Quantum Computing

- Utilizing quantum computing in designing portfolio optimization methods affords the potential for larger returns and decrease dangers in comparison with conventional strategies.

- Environment friendly optimization by means of quantum algorithms can result in higher decision-making and improved outcomes for traders in search of diversified portfolios.